AI in Forex: 5 Ways It's Transforming Currency Trading

Discover how AI is reshaping currency trading. Learn 5 key ways AI enhances forex analysis and decision-making.

The infusion of artificial intelligence (AI) into forex trading is driving a significant transformation, offering new paradigms for market participants. With its ability to process vast amounts of data and execute sophisticated algorithms, AI enhances precision and predictive power in forex markets. This article delves into how AI is revolutionizing forex trading, addressing SEO questions on the changes AI brings and the benefits it offers in currency markets.

Understanding Forex Market Dynamics

The forex market, one of the largest and most liquid financial markets globally, involves the exchange of national currencies, with exchange rates fluctuating based on economic factors and market sentiments. Understanding these dynamics is crucial for traders to navigate the market's complexities effectively.

Traditional Forecasting Limitations

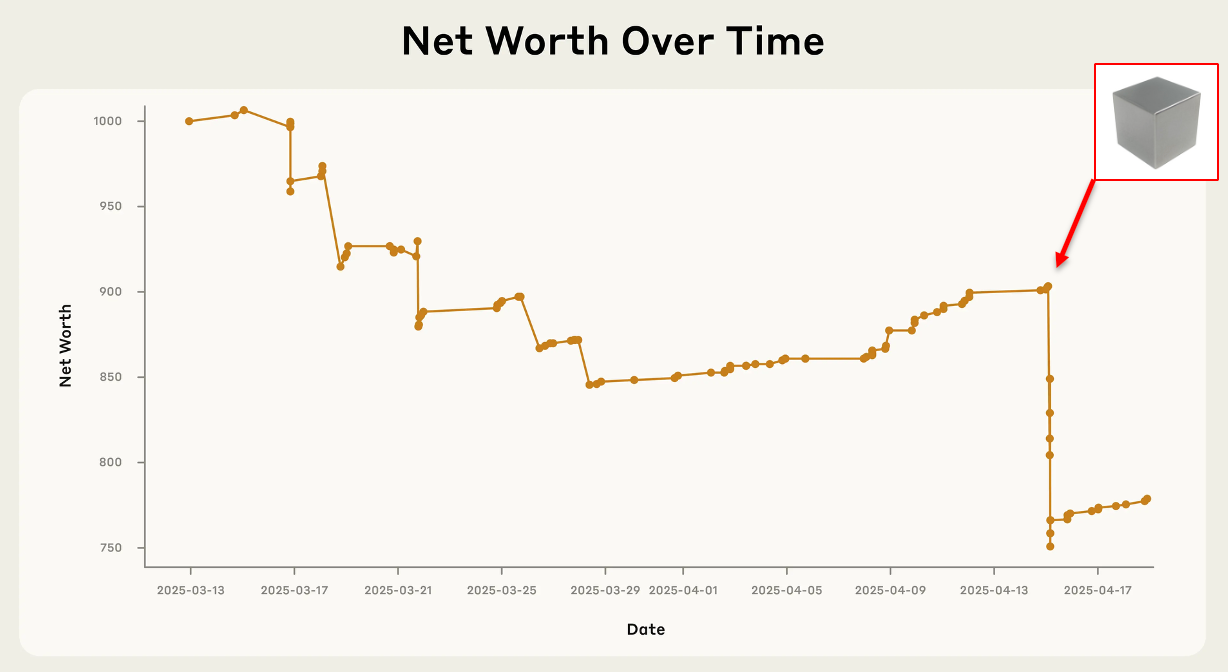

Traditional forecasting methods, such as moving averages and simple regression models, often fall short in capturing the market's complexity and volatility. These methods tend to oversimplify market dynamics, lack responsiveness to rapid changes, and struggle with high volatility, leading to incomplete analyses and potentially flawed predictions.

AI's Role in Forex Trading

AI in forex trading involves applying machine learning and deep learning algorithms to analyze historical and real-time market data. This technology can process vast amounts of data quickly, making trading decisions based on complex algorithms. AI systems can forecast market patterns, evaluate data in real-time, and make financial decisions with remarkable precision, offering a strategic edge in deciphering currency market trends.

AI Trading Strategies

AI employs various strategies to navigate the forex market:

- Trend Following: AI systems use historical data to detect trends in currency prices, determining whether a currency pair is on an upward or falling trend and executing trades accordingly.

- Mean Reversion: AI uses statistical analysis to identify scenarios where a currency's value has significantly deviated from its historical norms, indicating potential buying or selling opportunities.

- Mood Analysis: AI leverages natural language processing (NLP) to analyze news items, social media, and financial information to gauge market sentiment, aiding in informed trading decisions.

- Arbitrage: AI systems can identify price discrepancies for the same asset in multiple markets, allowing for profitable trades by capitalizing on these differences.

- Breakout Trading: AI can detect when currency prices break out of established trading ranges, executing trades to maximize profits.

Benefits of AI in Forex Trading

AI in forex trading offers several benefits:

Time-Saving

AI eliminates the need for extensive market analysis, allowing traders to focus on other aspects of their business. This efficiency saves significant time and resources.

Improved Decision-Making

AI provides traders with valuable insights based on real-time data, enhancing their decision-making capabilities. These insights can be crucial in making timely and informed trading decisions.

Enhanced Predictive Accuracy

AI enhances predictive accuracy by analyzing complex market patterns and trends. This capability allows traders to make more precise predictions about market movements, giving them a strategic edge.

Hands-Off Trading

AI enables hands-off trading, allowing traders to focus on other activities while the technology manages their trades. This automation can significantly reduce the workload and stress associated with manual trading.

Addressing Common Misconceptions

A prevalent misconception is that AI will render human traders obsolete. This perspective overlooks the nuanced role that human intuition still plays in trading. While AI excels at data processing and pattern recognition, it struggles to encapsulate the full spectrum of market complexities, including emotional and psychological factors that often drive market behavior. Therefore, AI should be seen as a tool that augments human intelligence rather than replacing it.

Conclusion

AI is undoubtedly reshaping the landscape of forex trading. The benefits of integrating AI into currency trading technology are multifaceted, from enhanced data processing speed and accuracy to the ability to harness diverse data sources for comprehensive market analysis. However, fully leveraging AI's potential requires a balanced approach that recognizes both its strengths and limitations.

The future of forex trading lies not in the obsolescence of human traders but in forging a collaborative synergy between human insight and machine efficiency. Only through a thoughtful, analytical perspective can stakeholders truly harness the transformative capabilities of AI in the forex market.

References

- Tharva Tech. (2024, July 1). How Artificial Intelligence Is Transforming Forex Trading. LinkedIn.

- Trovata. (2024, January 12). Harnessing AI for Enhanced Forex Market Predictions. Trovata.

- MK Library. (2024, February 22). AI In Forex: Transforming Currency Trading. MK Library.

- AI Advances. (2024, March 9). AI in Forex Trading: The Future of Profitable Investing. AI Advances.

- LinkedIn. (2022, April 14). How artificial intelligence is helping forex traders maximize profits. LinkedIn.